Describe How Taxes Can Be Used to Affect People& 39

No Tax Knowledge Needed. If taxes are lower in cities people have a stronger incentive to stay or move there.

Def 14a 1 Nc10019677x1 Def14a Htm Def 14a Table

Because of this contribution taxes help spur economic growth which in turn has a ripple effect on the countrys economy.

. Governments can create subsidies taxing the public and giving the money to an industry or tariffs adding taxes to foreign products to lift prices and make domestic products more appealing. Income Taxes Income taxes are a percentage of the money someone makes on their job. In the United States the more you make the higher percentage you pay.

How Taxes Influence Behavior. Effects of Taxation on Production. It takes resources away from the taxpayer and transfers them to the government.

Local authorities can also use tax discrimination in order to fight urban sprawl. This may also include the tax on housing. Select the three formulas that can be used to describe complementary events.

The fewer taxes paid the more disposable income citizens have and that income can be used to spend on the economy. For example higher taxes on carbon emissions will increase cost for producers reduce demand and shift demand towards alternatives. Taxation can influence production and growth.

Federal rates can be anywhere from 0 to 396 and state rates run from 0 to 133. High taxes were levied on certain foods items of. Taxation on goods income or wealth influence economic behaviour and the distribution of resources.

Puritan founders of the New England colonies used the earliest sin taxes called sumptuary taxes. Ad File 1040ez Free today for a faster refund. Choose the three formulas that can be used to describe complementary events.

The tax is used to discourage the purchase and use of products that pose a risk to health such as tobacco and alcohol. Source of government revenue. Raising the standard of living increasing job creation etc.

Legislators can thus in principle affect subjects decisions by defining the borderline between legality and illegality. Higher income tax can enable a redistribution of income within society but may. Ad TurboTax Makes It Easy To Get Your Taxes Done Right.

Only if we use moral priming to increase subjects. Income Effect of taxation. Ii effects on the will to work save and invest.

There are different types of income tax including federal state and local income tax. However once we introduce potential negative financial consequences legality does not affect tax minimization. 6425 because probability values cannot be greater than 1.

Estate taxes can be considerable but less than one-tenth of 1 percent of taxpayers have to pay them which means 999 of us dont have to worry about this. A tax that is paid to the government by consumers when they purchase particular. The estate tax exempts the first 117 million for an individual and 234 million for a married couple.

The tax reduces the purchasing power or real income of taxpayer. Although taxation itself is ubiquitous whether taxes have a positive or negative effect on the general economic condition of the country is the subject of much debate. Match the clues below to their correct answers by choosing from the drop-down menu.

Continue to Part 2 or click the Check My Answers button at the bottom of the page to assess your answers. Answer Simple Questions About Your Life And We Do The Rest. Taxes is a source of government funding and allow the government to spend the money on improving the countrys infrastructure.

In Tennessee for example consumers can pay as much as 944 in sales taxes when combining state and local taxes according to the Tax Foundation. Such effects on production are analysed under three heads. A government will also increase its.

23 March 2019 by Tejvan Pettinger. Iii effects on the allocation of resources. Taxes can affect the economy in a number of ways ranging from national and local economic growth to how individuals manage their personal finances.

I effects on the ability to work save and invest. The increase in the relative price affects the taxpayer in two ways. Taxes help in the redistribution of wealth by allowing high-income earners pay more taxes compared to low-income earners.

In 12 states sales taxes are higher than 8. Furthermore taxes can affect the state of economic growth of a country. Taxes generally contribute to the gross domestic product GDP of a country.

Estate taxes are imposed on the transfer of property upon the death of the owner. P E1-P E P E1-P E Determine whether the statement is true or false. This means that municipalities could charge fewer taxes on certain services if people live in cities compared to suburbs.

Deere Reports Net Income Of 1 283 Billion For Fourth Quarter 5 963 Billion For Fiscal Year

Ex 99 1 2 Tm2122173d1 Ex99 1 Htm Exhibit 99 1 Exhibit

Kim Johnson Kimjohnson2um Amazing Quotes Life Quotes Words Quotes

Deere Reports Net Income Of 1 283 Billion For Fourth Quarter 5 963 Billion For Fiscal Year

People Strategy Adidas Annual Report 2019

Deere Reports First Quarter Net Income Of 903 Million

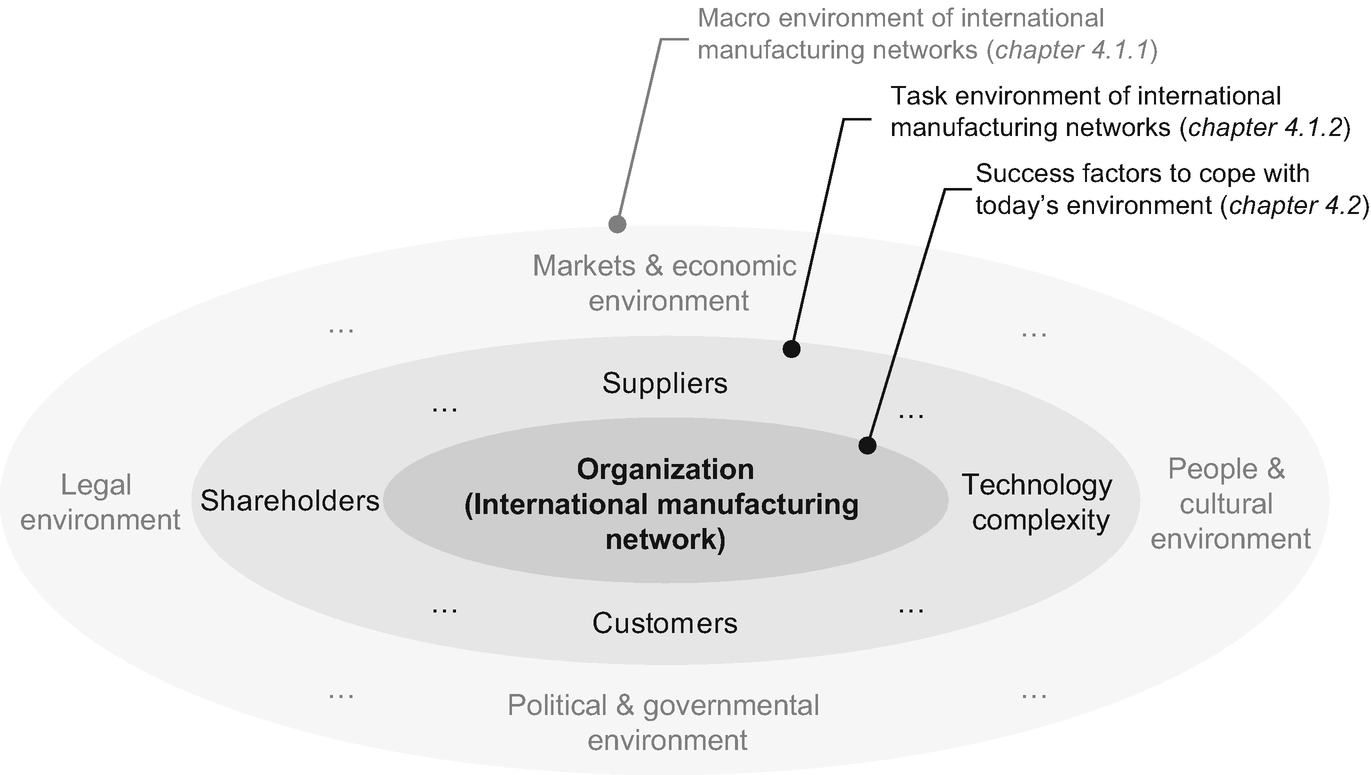

Managing International Manufacturing Networks In Today S Business Environment Springerlink

Comments

Post a Comment